Introduction

Real estate has always been a cornerstone of wealth-building. Even in 2025, with fast-changing

markets and the rise of digital assets, real estate continues to be one of the safest and most

rewarding investments.

Whether you are a first-time buyer or an experienced investor, knowing the market is the key this blog will help you understand:

- Why real estate is still a smart move in 2025.

- How to choose the right property for long-term value and returns.

Date- 13/07/2025 https://www.digitalsilk.com/digital-trends/best-real-estate-websites

WHY ? Investing in Real Estate is a smart move.

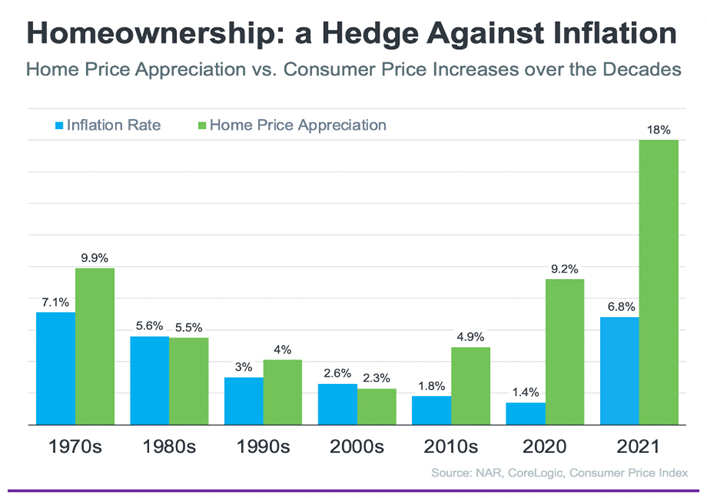

1. Hedge Against Inflation.

Inflation eats away the value of money. But with real estate, the value of your investment tends to rise with inflation or even outpace it.

📈 For example, if inflation is at 6%, property prices and rental income often rise around or above that mark, preserving your purchasing power.

💡 Real estate = real value. Unlike money sitting in a savings account, land and property are inflation-proof stores of wealth.

2. Reliable Passive Income Stream.

Rental income provides a steady, monthly cash flow. In 2025, with rising urban population and hybrid working culture, rental demand is high, especially in:

- Tier 1 cities like Mumbai, Bengaluru, Delhi

- Student hubs like Pune, Ahmedabad

- Tourist zones (for Airbnb or short stays)

🧮 Example: A ₹50 lakh apartment in a mid-level area can yield ₹15,000–₹30,000/month in rent depending on location.

💸 This makes real estate a favourite for those seeking financial freedom or retirement income.

3. Tangible and Secure Asset.

Unlike stocks, mutual funds, or cryptocurrencies, real estate is something you can see, use, live in, or improve.

🏡 Whether you are buying a small plot, a 2BHK flat, or a villa—it is a real, physical asset. It is not subject to market crashes overnight like digital or paper-based assets.

🔐 Real estate is especially attractive for conservative investors and those who value stability over volatility.

4. Tax Benefits & Financial Deductions.

The Indian government continues to encourage homeownership through tax incentives. In 2025, you can still claim:

- Up to ₹2 lakh deduction on home loan interest under Section 24(b)

- Up to ₹1.5 lakh on principal repayment under Section 80C

- Tax deductions on registration charges, stamp duty, and home insurance

- Additional benefits for first-time buyers under affordable housing

📊 These tax breaks significantly reduce your net investment cost—especially for salaried individuals.

5. Appreciation in Property Value.

Real estate appreciates over time—especially in growing markets. In India, Tier-2 and Tier-3 cities like Indore, Lucknow, Kochi, and Jaipur are seeing:

- Infrastructure development

- Smart city initiatives

- IT hubs and industrial corridors

🛣️ Example: Properties near metro expansions, new airports, or highways have seen 20–40% growth in just 2–3 years.

🏆 Smart investors in 2025 are moving early into growth pockets, before prices explode.

6. Leverage: Do More with Less

With real estate, you can control a high-value asset with a relatively small upfront investment.

💳 Example: Buy a ₹50 lakh flat with just ₹10–12 lakh down payment + EMI. If property value increases by 20%, your equity grows much faster.

📈 You earn appreciation on the entire property value—not just your share.

🧠 This amplifies your returns and helps build wealth faster than many other investment options.

https://www.investopedia.com/the-best-real-estate-crowdfunding-sites-8761523

7. Diversification and Safety

Real estate adds diversification to your portfolio. It’s not directly tied to stock market fluctuations. So even if your mutual funds or SIPs dip, your property value may remain stable—or rise.

⚖️ A well-balanced portfolio in 2025 includes real estate, equity, fixed income, and digital assets—not just one or two.

8. High Emotional + Practical Value

Besides money, property offers peace of mind. You can:

- Live in it

- Rent it

- Gift it to your children

- Use it as collateral

❤️ It is both an investment and a legacy.

How to Choose the Right Property for You (🧭 Step-by-Step Guide)

HOW TO INVEST IN REAL ESTATE ?

- Define Your Investment Goal. 🏙️

Ask yourself:

- Do I want monthly rental income?

- Am I buying to sell at a profit?

- Do I want a vacation or second home?

➡️ Clarity helps filter options quickly.

2. Choose the Right Location. 📍

Location is everything in real estate. Look for:

- Upcoming metro lines or highways

- Proximity to IT parks, schools, malls

- Future government development plans

- Crime rate and safety

- Local demand for rental/resale

3. Set Your Budget. 💰

Include these in your calculation:

- Down payment

- Loan EMI (ideally not more than 40% of your income)

- Stamp duty, registration, interiors

- Maintenance costs (for apartments)

4. Research Property Types. 🔎

Choose between:

- Apartments

- Villas or independent houses

- Residential plots

- Commercial properties

- Under-construction vs ready-to-move

Each has different returns, risks, and entry costs.

5. Check Legal Documents Carefully 📄

Ensure:

- Title deed is clear

- Property is RERA registered

- Completion Certificate (CC) and Occupancy Certificate (OC) are available

- Sale deed and home loan eligibility

➡️ Always consult a property lawyer if you are unsure.

6. Evaluate Builder Reputation. 🧱

Do not fall for just the sample flat. Check:

- Past delivery timelines

- Quality of previous projects

- Online reviews and buyer complaints

- Financial condition of the builder

7. Study Rental & Resale Potential. 📊

Check:

- Current average rental in that area

- Price growth in the last 5 years

- Future infrastructure plans

- Vacancy rate

8. Consult a Real Estate Advisor. 🤝

An expert can:

- Shortlist verified properties

- Negotiate better deals

- Explain legal and tax aspects

- Save your time and risk

Read more: How to buy a home?

Conclusion ✍️

In 2025, real estate continues to offer stability, growth, and income—a rare combination in today’s financial landscape. Whether you’re looking to build your first asset or expand your investment portfolio, the key lies in choosing wisely. Follow this structured approach and invest in your future—brick by brick.